Property has always been a major investment avenue of the rich. Now, some of the people one would expect to focus on enterprising ventures are also looking at rent-yielding property.

Infosys co-founder NR Narayana Murthy’s family office has bought high-end luxury apartments in Bangalore and Mumbai, said sources familiar with the development. Catamaran Ventures, which manages part of Murthy’s wealth, has previously invested in e-commerce, FMCG and education ventures.

Sources told TOI Catamaran Ventures, which manages Rs 600 crore of funds, had invested at the pre-launch phase, providing scope for steep appreciation once the projects are completed.

While A-grade commercial office space gives a annual yield of 10% in India, residential properties give an average yield of 3%-4%. In some luxury residential properties, the yield could touch 7%.-from TOI

To know what Catamaran Ventures is buying,holding and selling,subscribe to our Investor Wisdom Newsletter

Category: Realty

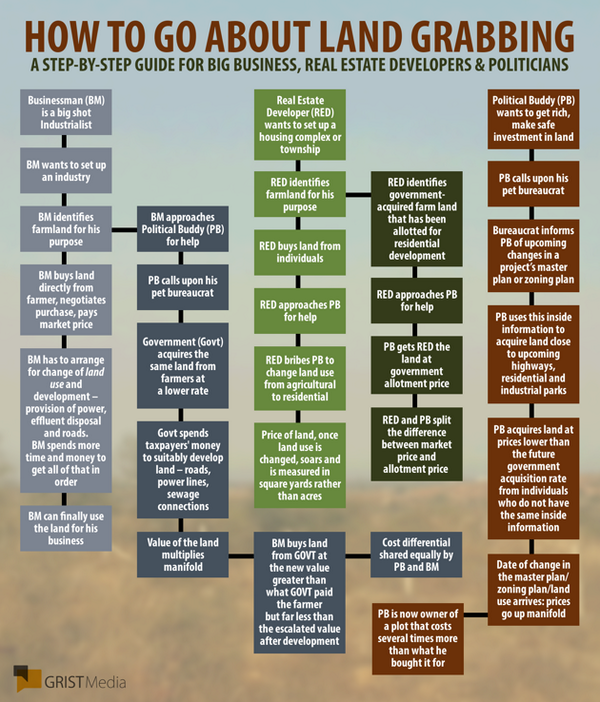

How to grab land in India

Source:Yahoo

Hat Tip Kevin

A group of NRI investors have filed a case in the Supreme Court of Mauritius against ICICI Venture Funds Management Company accusing the PE firm of misleading them while raising a real estate fund that eventually underperformed while they had been promised a certain return.

Around 69 investors, mostly from the United Arab Emirates and Gulf Cooperation Council (GCC) countries, had invested around $34.7 million in the $220-million Dynamic India Fund (DIF) III since 2005, after being allegedly promised a return of 25%. Instead their investments are now under water.The investors claim that the fund manager did not keep them informed about the subsequent performance of the fund or about the quality of assets in which the fund had invested. Further, the aggrieved investors allege there was huge delay in completion of projects about which they were also kept in the dark.

When the fund’s tenure came to an end, they were told that their investments were valued below par.

At that stage ICICI Ventures asked them to remain invested for another three years. Instead these investors have approached the Mauritius legal forum claiming $69 million in damages.-from ET