India Ratings claims itself to be “India’s Most Respected credit rating agency committed to providing the India’s credit markets with accurate, timely and prospective credit opinions”

However their actions with respect to Ricoh India is so scandalous that Anil Singhvi wants the company to be banned:

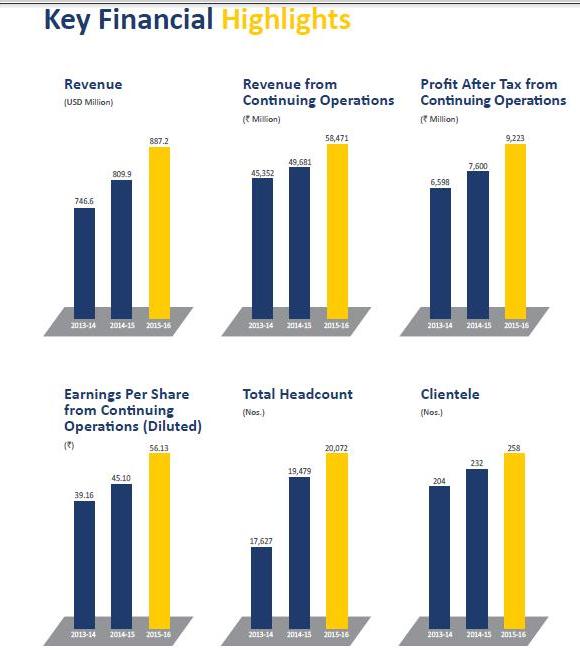

“In Ricoh India case also, is no further than Satyam because it is all padded up. The revenues are padded up, the receivables are padded up, the inventory is padded up.

So, I have just gone through all the numbers of the September quarter and the previous quarter as well and it is identical to what Satyam was. Satyam was also completely padded up on revenue side and on receivables side.

There are only one or two points which one has to just look at it. The total borrowing two years back in March, 2014 was Rs 367 crore which went up Rs 716 crore last year, that is March, 2015. And now, it is Rs 1,300 crore. A company which does not incur a single rupee as a Capex, the loans going up from Rs 300 crore to Rs 1,300 crore. And the parent has provided Rs 500-600 crore. They have given Rs 200 crore of non-convertible debentures (NCD) and Rs 270 crore of commercial papers (CP).

And top of it, you will laugh your guts out. The rating agency, on January 22, 2016 have upgraded the rating of both the instruments, the long-term bonds and CP from A to AA minus.

And CP is a A plus. The top rating given by India rating. And January, 2016 with an outlook, stable.

First of all, and my point is very simple, look at the rating agency’s situation, in January, when this board is caught up into all the situation, grappling with the problems and having the situation that till January, 2016 there are no availability of any accounts. How did the rating agency get any accounts between April to September, if the shareholders did not have it? So, on what basis did they give an opinion?

Without having any accounts available after March 31, 2015, on what basis have they upgraded from A to AA minus? They should be first of all, according to me, India ratings should be first banned in India.

-from MoneyControl