Hat Tip : U No Hoo

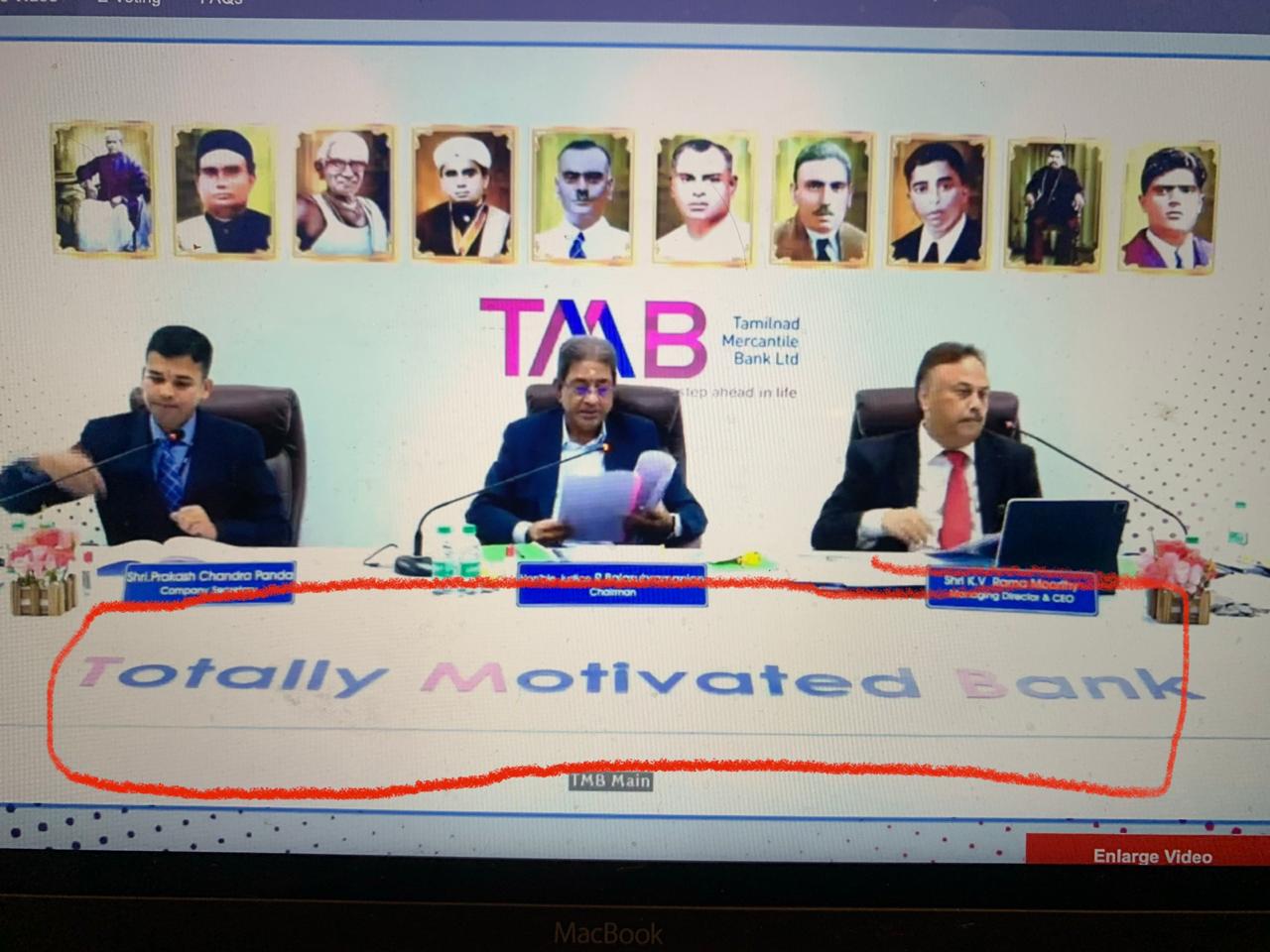

The Tamilnad Mercantile Bank was set up in 1921 and held its AGM today.

Yesterday , on Guru Purnima, I attended the AGM of HDFC AMC. This was their first AGM after going public and hence was special.

There I got to observe one of the greatest wealth creators of India and Guru to many, Deepak Parekh in action.

What I learnt from him was HIT (H – Humility, I-Integrity, T-Thriftiness)

Humility: I was astounded to see the humility with which Deepak Parekh conducted himself. Most managements consider retail shareholders to be a pesky lot and their irritation is quite evident on their faces.

On the other hand, our Guru was courteous to a fault. He got up to ask and answer queries,took copious notes of shareholder queries and answered each shareholder by name.

Integrity: Deepak Parekh , over the course of his career, has created incredible wealth for his shareholders. The love they have for him has to be seen to be believed. One gentleman mentioned that he had put 1000 Rs in HDFC many years back and now its worth 1 Cr ! They all complimented on his fairness and sense of justice especially towards minority shareholders. This is such a 180 Degree difference from some of the AGMs I have attended where shareholders often call promoters ‘chors’ etc

I really liked the way he handled the Essel issue head on.After listening to him, you feel that you can trust him to take the best decision in the larger interests of the Company.

Thriftiness: In any AGM, a shareholder can expect to some kind of light snacks-say a soggy samosa,stale sandwich or a hard idli. I was amused to see that the only thing that was served was a cup of chai/small cold drink. In a way, it was comforting that India’s largest AMC is not spending unnecessary money. Such a strong culture can come only from the top.

All in all, this Guru Purnima was a HIT for me !

I attended the 15th AGM of Yes Bank today.

The hall was packed and it was standing room

I was astonished to see Bouncers in the audience.

Normally, Bouncers at a AGM are a very negative sign since it implies that the management fears violence from its own shareholders

The proceedings started promptly on time

The Chairman Brahm Dutt went through the Notice and the official part of the AGM got over very quickly.

Now was the time for Q&A.

The Chairman announced that they have already received questions and will call in the order of names in the Speaking List. All the Questions will be answered in the end

To my shock and those of other shareholders, it became fairly clear that the members called to ask Questions to the management (Speaking List) were some notorious characters.

These characters are very well known to AGM veterans and often have an agenda different from a genuine shareholder. They are often in cahoots with the management and ask planted Qs and don’t let genuine shareholders air their grievances

As expected, one by one of these characters came on stage as if following a planned script.

Their comments/questions followed a straight line like a Mumbai Local:

-Thank you for sending me the Balance Sheet (Their script didnt use the words ‘Annual Report’) on time

-Congratulations for posting good numbers (?) in this difficult period

-Welcome to the new Lady Directors on Board.Now Goddess Lakshmi is represented on the Board

-Thank you for generous dividends

-We hope you take the Company to new heights

-Congratulations on the various awards won by the Bank

-Congratulations on the great CSR activities done etc

And so on….

Some of the comments by these speakers are cringe worthy:

“Balance Sheet is very beautiful”

“Aap Yes Bank Ko # 1 Banaoge, Virat Kohli Ki tarah Sixer Pe Sixer Maroge”

“Yes Bank is very near and dear to my heart. Under the renowned (?) leadership of Mr. Gill, the stock will become a multi-bagger”

“Thank you for the Balance Sheet which is full of knowledge”

“Can you take us on a trip to Mt.Abu where you gave a lecture on stress management”

“Can you share the future road map of last 3 years?”

“I have looked at the photographs in the Annual Report.Your photos indicate that you have good hope for the future”

The height of the ridiculous happened when one Mr. Ashish Chandak took the dias.

He claimed he was an Employee-Shareholder and represented the employees of the Company

He said “I will speak Dil Se, Man Ki Baat Karunga”

Started saying stuff that employees work day & night for the Bank etc etc. Said the Bank works in a Professional Entrepreneurship framework and this will rescue the Bank from the turmoil that it is in.

He said the Bank pre-split was Rs.8 and now its Rs.135…Investors should not fear etc

He was going to quote Ronald Reagan when genuine investors had enough and told him to shut up.

After that a genuine investor took the dias. He mentioned that the Bank was known for cooking its accounts, now even the speaking list (people called to ask Qs) was cooked. The speaking list, in his opinion, was prepared on 10th June itself !!

Then he mentioned that employees, along with Rana Kapoor, should have been kicked out for landing the Bank in this mess. This got some applause from the audience

Finally, it was the turn of the Board of Directors to answer the Questions

Ravneet Gill made short work of them.As per him, he grouped the questions into four parts and answered as follows:

Part 1 – Future Strategy :

Will continue to remain a Corporate Bank.Retail Banking and Commerical Banking will help diversify. Main aim is to bring down the cost of funding

Part 2 – Asset Quality:

Market has responded very conservatively to our asset quality issues. A handful of our large exposures have liquidity issues.Moodys downgrade is because of them.This will take some time to resolve.

Allied to this is capital raise. All options -Public QIP or PE- are on the table.Will revert back on this in short order

Part 3 – Technology

Yes Bank is the leader in digitisation and expects technology to build new businesses, address consumer needs etc. Genuinely thinks Yes Bank is a leader in Technology

Part 4 – Perception of the Bank

Banks are institutions of public trust and will work to improve the perception. Gave a handsome dividend to send a message to shareholders that we are confident of the Bank’s future

Parting words of Gill to shareholders “We will strive to remain worthy of the trust and support you repose in the Bank”