Some stuff I am reading today morning:

Infosys ADR plunges 8% on NYSE (BT)

Govt kicks off Direct Tax Code revision (FE)

China dumping APIs in India (Fortune)

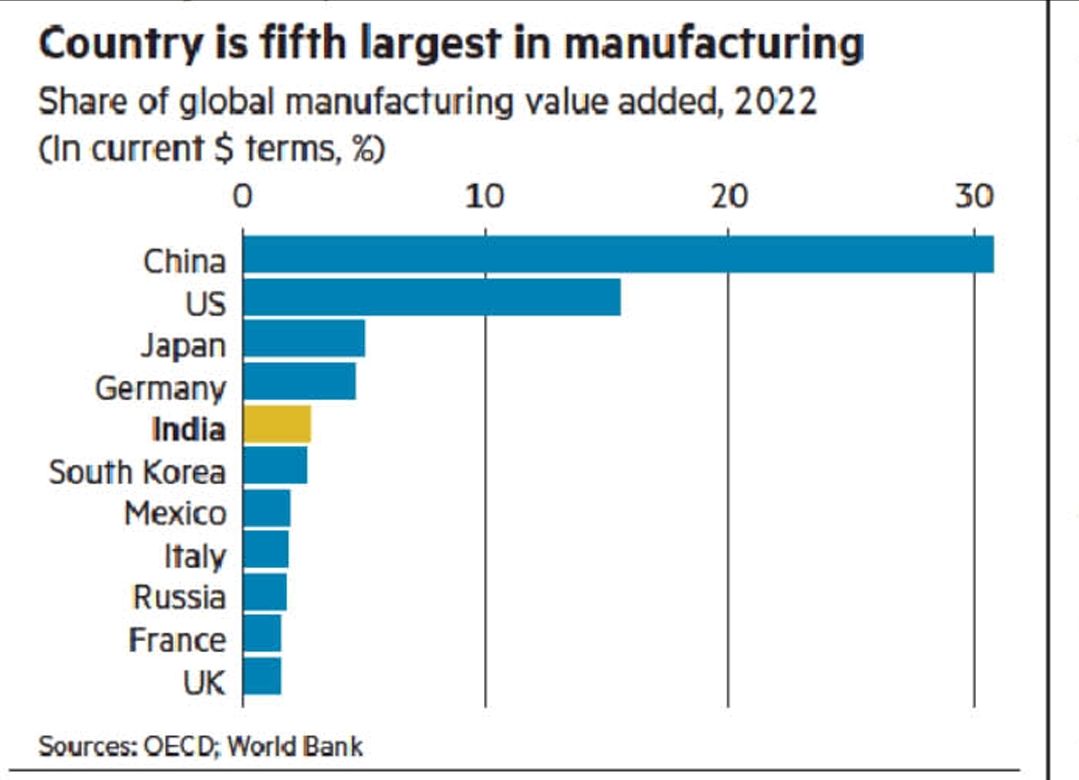

Expensive India lures investors away from China (Bloomberg)

China is peeved with Elon Musk’s pivot to India (MC)

America’s debt, World’s problem (CNN)

Market Gossip & Tales (BW)

David Samra on Swiss stocks (The Market)

What is Bitcoin meant to hedge? (Coin Desk)

The Market Size Mistake (Tomasz Tunguz)