Heard on Street :

Stock market crisis wont last long. After all, it was Made in China 😊

— Priyankar Sarkar (@spriyankar) August 25, 2015

What to do in this crash?

The current crash will prove to be a perfect example. In the short run, markets get influenced by global or other extraneous factors. However, in the medium to long run, the only thing that matters is the state of the local economy. The Indian economy is clearly in a steady recovery mode. The indicators are many. Inflation is down and interest rates will follow. Macroeconomic indicators are gaining health, with the current account deficit almost gone and the fiscal deficit in control. We are one of the few emerging market economies that actually benefit sharply from the fall in the commodity prices that is accompanying the crash. Today, we have one the best growth trajectories in the world.

In the medium-term, this is what will decide the direction of our stock markets. You might hear a lot of discussions about whether this crash is a buying opportunity or not. The answer is that in a growing economy, it is always a buying opportunity. A steady, systematic investment strategy was the right one a decade ago, a year ago, and a week ago, and so it is today, and so it will remain for the foreseeable future.

–wrote Dhirendra Kumar

Source:Prashant

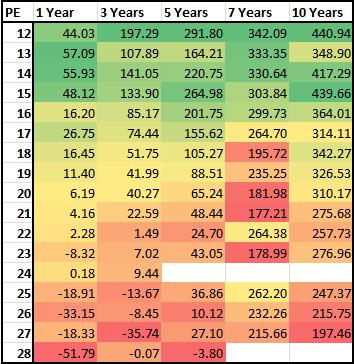

The following table should provide you with perspective on what to expect (based on historical averages) if you were to buy at X times earnings on Nifty

Who bought what yesterday

Yesterday was a day of carnage in the markets.Interesting to see these entities pick up shares in bulk .

| Date | Symbol | Security Name | Client Name | Buy / Sell | Quantity Traded | Trade Price / | Value (In Crores) |

| Wght. Avg. | |||||||

| 24-Aug-15 | ESCORTS | Escorts India Ltd. | GREATER INDIA PORTFOLIO | BUY | 660521 | 154.41 | 10.20 |

| 24-Aug-15 | GHCL | GHCL Limited | OCEAN DIAL GATEWAY TO INDIA MAURITIURS LTD | BUY | 924034 | 115.87 | 10.71 |

| 24-Aug-15 | INDTERRAIN | Ind Terrain Fashions Ltd | MALABAR INDIA FUND LIMITED | BUY | 45505 | 599.02 | 2.73 |

| 24-Aug-15 | JUBLINDS | Jubilant Industries Ltd | EQUITY INTELLIGENCE INDIA PRIVATE LIMITED [P M S] | BUY | 100000 | 238.39 | 2.38 |

Intra Day Market Calls

Maybe my favorite thing about today – watching fundamental analysts making intraday directional market calls.

— Downtown Josh Brown (@ReformedBroker) August 25, 2015