Category: Observations

Ambanis: All in the Family

This news article about RCom shutting down it’s 2G wireless business has led me to observe that the Ambanis are a remarkable family.

Brahma: The Creator

Vishnu: The Preserver

Shiva:The Destroyer

In an Investor Meet held some months back, Anilbhai proclaimed “We will be like Arjun, focussed on a single target…we will make Reliance Capital the premier financial services company”

Fast forward to today’s news:

Lenders to GTL Infrastructure declined to share information about the Company in an effort to block a Reliance Capital arm from bidding for the telecom tower company. GTL Infra, where lenders currently own a majority, is running a sale process as part of a strategic debt restructuring exercise. After a decision to deny the Anil Ambani group company from bidding at the joint lenders’ forum (JLF), lenders plan to send questions to Reliance Capital Advisory Services (RCASL) seeking clarity on its intent of the purchase.

The bankers at the JLF expressed concerns over Reliance Capital’s intention to buy GTL Infra, given that its parent group is exiting the telecom tower business. They also discussed RCom’s own strategic debt restructuring plan which is under way and the dues Reliance Communications, the flagship company of the group, still has to pay GTL Infrastructure.

Maybe for the hapless shareholders of the ADAG Group, it would be better if Anilbhai becomes less like Arjuna and instead becomes like Ram and takes a 14 year vanvaas !

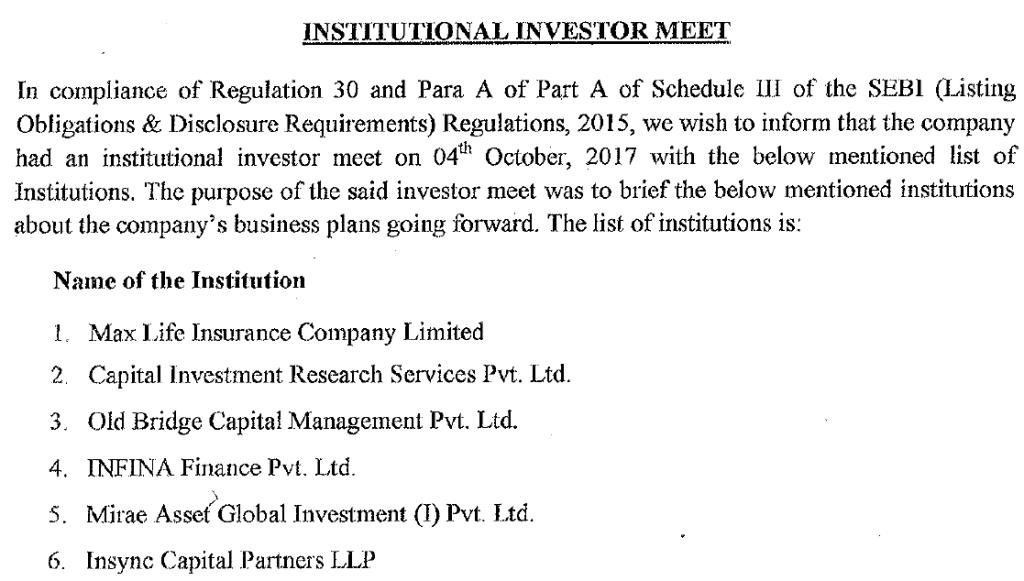

On 4th October, 2017, JHS Svendgraad Laboratories Ltd had a meeting with institutional investors.

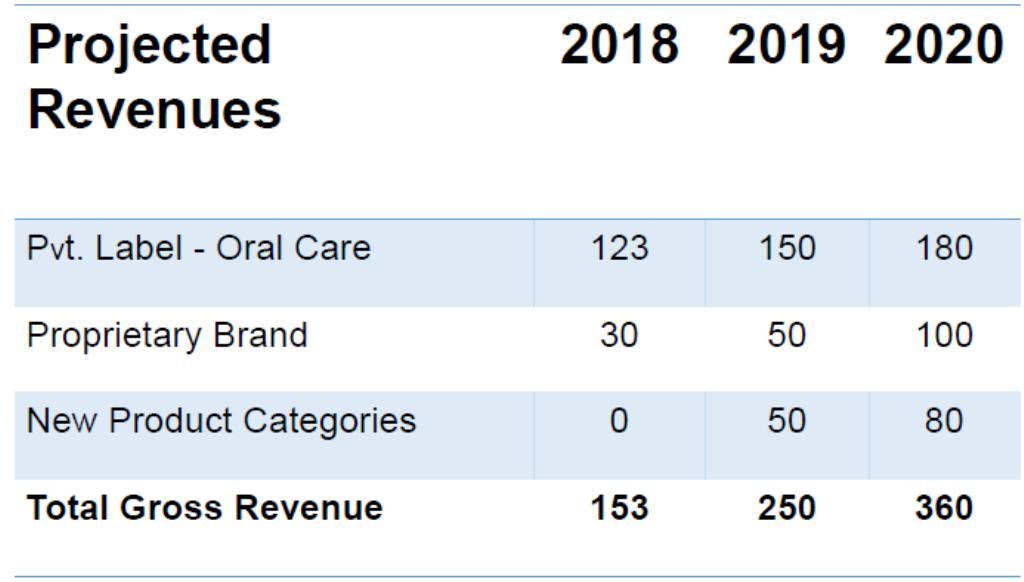

In the investor presentation to these investors, future plans of the Company was discussed and the following future revenue projections were shared:

Since then, the share price of JHS is hitting the upper circuit every day.

But what is crucial and important is the investor presentation was shared to the general public and retail investors only on 5th October,2017 after the markets got closed.

Jago,SEBI Jago !!

Exactly one year back on 22 Sept,2016 , L&T Chairman A M Naik had said this:

“We made some changes in L&T Finance and it is now on track to growing return on equity. This will drive share prices more and it will cross Rs 100 in three-four months and Rs 150 by December next year ”

Now L&T Finance share price is now trading at all time highs at 213 Rs/share, comfortably beating the Chairman’s expectations.

Maybe the good folks at L&T don’t want to let their Chairman down.

So it’s interesting to hear what the esteemed Chairman has to say about L&T’s share price:

We have already touched Rs 1,70,000 crore worth of market cap. When I took over, it was Rs 2,500 crore, so now Rs 2,500 crore to Rs 1,20,000 crore is roughly 70 times what I told you and that to go to Rs 2,50,000 crore should not be difficult. I think we will be able to achieve that by 2021.