Are equities always the best investment for the long run? It is the message that is usually sold to individual investors. The message is based on theory; equities are riskier than government bonds so should offer a higher return (the equity risk premium, in the jargon) to compensate investors. And the message seems to be borne out in practice, most of the time.

But there is an important caveat. Much of the data quoted by investment advisers is based on America, which is something of an outlier; it turned out to be the most successful economy of the 20th century but that was not guaranteed in advance. An investor in 1900 might have picked Germany as a rising power, only to see their assets wiped out in the 1920s hyperinflation and the Second World War; they might have picked Argentina, which was a perpetual disappointment. In other countries, there have been very long periods in which equities have not been a great investment.

Elroy Dimson, Paul Marsh and Mike Staunton of the London Business School are the acknowledged experts on global investment returns, having compiled data covering 22 countries over more than a century. As of February 2013, the longest period of negative real returns from US equities was 16 years. But it was 19 years for global equities (and 37 for world ex-US), 22 for Britain, 51 for Japan, 55 for Germany and 66 for France. Such periods are much longer than most small investors would have the patience to wait.

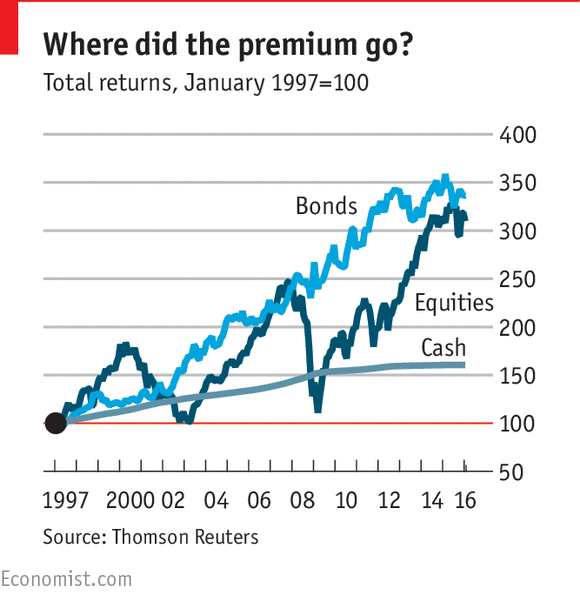

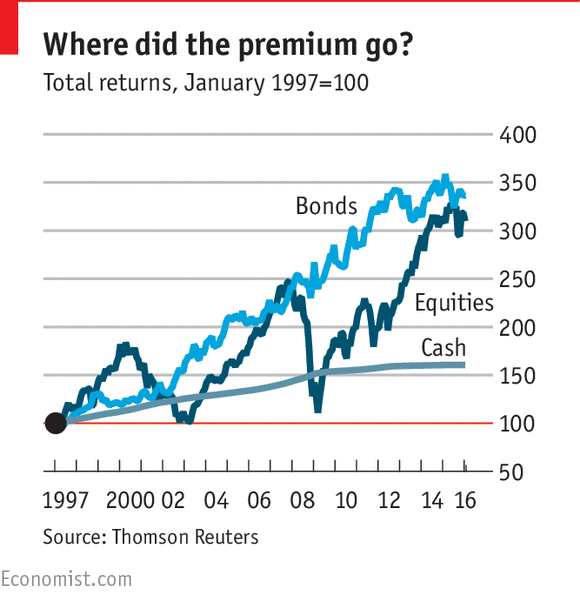

Another way of looking at the same issue is whether equities beat bonds over the long term; whether the risk premium is really delivered. This chart, a favourite of Albert Edwards of SocGen, shows the returns from equities (MSCI World, including dividends), long-dated government bonds (over 10-year maturity) and 3 months dollar cash since 1996. Bonds are still winning, even after the big recovery in equities since 2009.

from The Economist