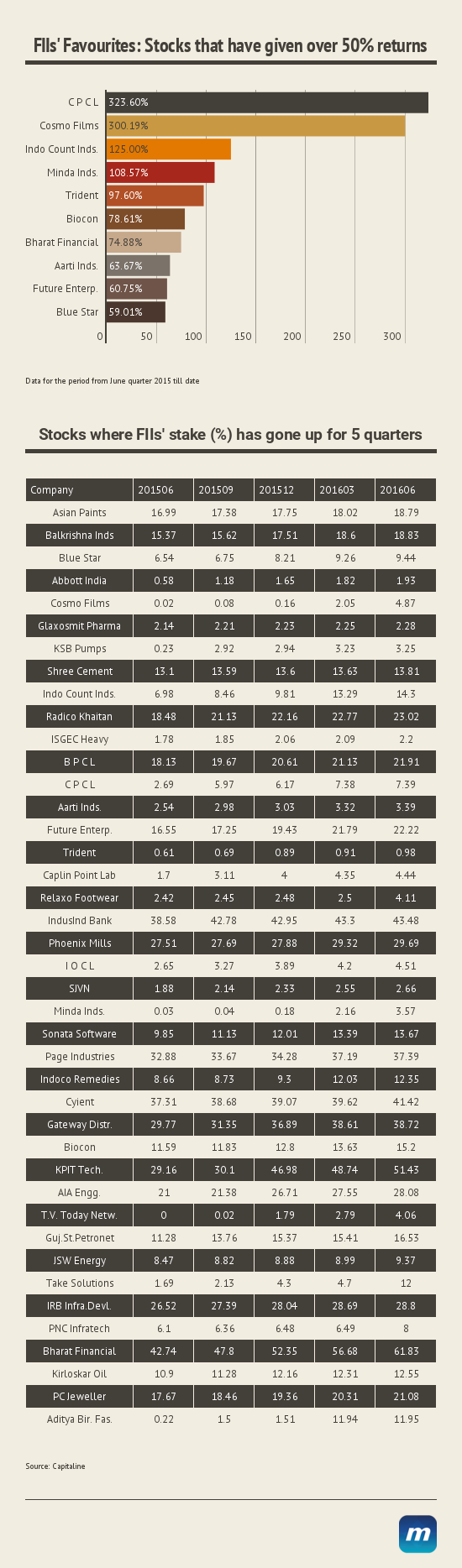

Source: Money Control

Author: Raoji

Linkfest: August 11,2016

Some stuff I am reading today morning:

RBL Bank IPO to open on August 19 (BL)

Cyrus Mistry:Tata Motors stock not for faint hearted (ET)

JSPL defaults (FE)

In search of India’s Dollar Shave Club (Mint)

Telcos: RJio is choking our networks (BS)

India’s cash-for-gold lenders headed for shakeout (Bloomberg)

Interview with Ambit’s Andrew Holland (Money Control)

The best stock market indicator (Price Action Labs)

Distractions cost investors 115% (Irrelevant Investor)

This market makes no sense (David Rosenberg)

Employees & Shareholders

The presentation that has created an earthquake in India’s financial circles

[slideshare id=64679460&doc=indianbanking-inatimeforchange-nandannilekani-160804023137]

Portfolio of Credit Suisse in India

This post is in continuation of my coat tailing series (see here)

To know what other top investors are buying/holding/selling in India, subscribe to our Investor Wisdom Newsletter

Credit Suisse is a well known FII investing in the Indian Markets.

Its significant holdings in India as on 30 June,2016 as per Stock Exchanges is given below:

| Company Name | Symbol | Entity Name | Date End | # of Shares | % | Value (In Crores) |

| Aegis Logistics Limited | AEGISCHEM | Credit Suisse (Singapore) Limited | 201606 | 6790799 | 2.03 | 84.95 |

| Apollo Tyres Limited | APOLLOTYRE | CREDIT SUISSE (SINGAPORE) LIMITED | 201606 | 8396877 | 1.65 | 153.28 |

| Axis Bank Limited | AXISBANK | CREDIT SUISSE (SINGAPORE) LIMITED | 201606 | 49535139 | 2.15 | 2843.81 |

| Indiabulls Housing Finance Limited | IBULHSGFIN | CREDIT SUISSE (SINGAPORE) LIMITED | 201606 | 7725788 | 1.85 | 623.36 |

| JB Chemicals & Pharmaceuticals Limited | JBCHEPHARM | CREDIT SUISSE (SINGAPORE) LIMITED | 201606 | 1028068 | 1.21 | 29.62 |

| Sonata Software Limited | SONATSOFTW | CREDIT SUISSE (SINGAPORE) LIMITED | 201606 | 1184169 | 1.13 | 18.09 |