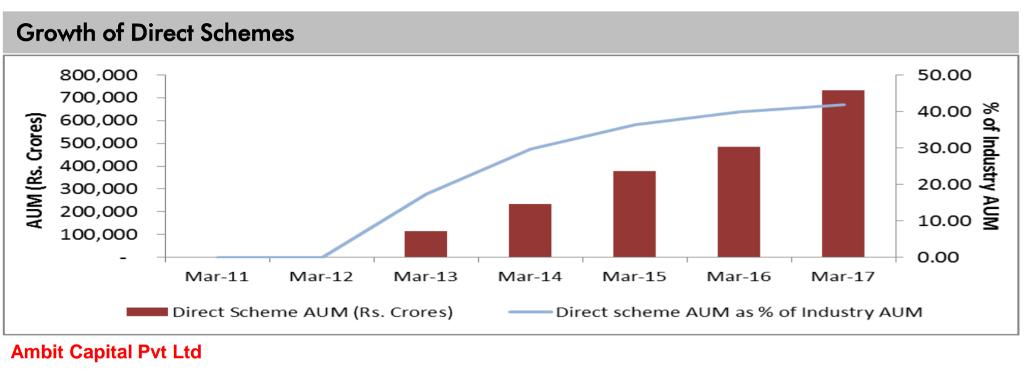

This market resembles 1994-1995 that was the first bull market where FIIs were allowed entry into India and you had a massive liquidity boom from FIIs.

Just like that, we are seeing a big liquidity boom from local investors in this cycle.

What did I learn from 1994-1995 boom?

I learnt that you will have to actually implement asset allocation. Once the market goes into bull frenzy, you have to practice asset allocation.

The second learning that I learnt from 1994-1995 was that you do not move from good quality companies to bad quality companies just because they are cheap on price to earnings or price to book or things like that.

The third is that you cannot believe that you will actually get an exit on the way down. In 1994-1995 boom, no one got an exit on the way down. So I believe that it is very important to maintain your asset allocation in equity but if people think that they will be the last person correctly exiting the markets that is not going to happen