Ajay Piramal-backed Indiareit Fund has sought consent from investors in its real estate private equity fund for another extension of the product’s tenure by a year. Indiareit Fund Scheme III, which was launched in July 2007, is due to mature in July 2015. The fund was to mature in July 2013 but it had sought investor approval to push the tenure by two years at that time.

In a letter addressed to investors, Piramal Fund Management’s managing director Khushru Jijina said the stated time periods are essential to realise the estimated values, and without the extension, monetisation would become extremely difficult. He believes any shorter time bound liquidation would significantly hamper the residual values. “We laid out and followed an assetwise strategy in order to bring the remaining investments closer to final realisation,” said Jijina in the letter.

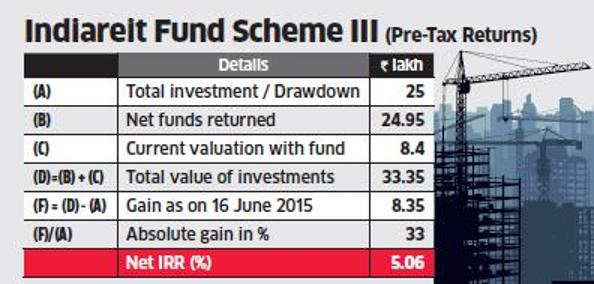

Rich investors put money in this fund in 2007— the peak of the previous stock market bull run— as real estate prices were showing no signs of fatigue. Then, the fund raised close to Rs 600 crore. Investors had to shell out at least Rs 25 lakh to participate in the fund. The fund returned 99.83%, or Rs 24.95 lakh, of the total capital called by the fund.

“Though investors made an absolute return of 33%, the IRR from the fund works out to a mere 5.06%,” says Manoj Nagpal, CEO, Outlook Asia Capital. In addition to the low return, there is uncertainty when the balance money will come back. –from ET

14 replies on “Piramal’s IndiaREIT Investors get screwed”

When are REITS funds going to open for small investor as proposed, With minimum investment of 2 lakh?

Are in you a hurry to lose your money ?:)

I am one of the screwed investor of indiareit scheme iii. How can i fight back

With the ‘final’ payout made recently, the IRR works out even lower than 5.06%. Professional Chors who continue to try to get public money with fancy brochures , graphs and whatnot. Once they have your money all the updates are about how difficult the market has become, the gloomiest pictures are presented . I invested 25 lakhs and I was a fool.

I am also one of the investors that got jacked by the indiareit fund 3. After frigging 9 years they screwed us royally. Can we as investors fight back – go to SEBI or Company Lawrence Board etc? Any thoughts on this would be great!

We need a lawyer and form a forum on whatsapp/ tweeter. Let all the gullible investors come forward.

Thanks

Dipankar Ghosh

Yes Dinakar. Let’s get together. Can’t we ask those Piramal guys for the list of investors and contact them?

I also feel we should haul up the “so called” investment advisors like the ICICI wealth management team, who literally coerced us to invest money in this scheme. In fact, but for ICICI, I would not have touched them. I also invested 25 lakhs and lost money. What 5.06%, the correct figure is around half of that. While the investors got a raw deal, the Piramals buy the sea side bungalow.

How do we get a list of all investors of this fund? Together we can do something!

Piramal & ICICI ( I’ve had terrible experinces with ICICI Lombard Healthcare)are Chor companies ! They manipulate and misrepresent when marketing with glossy brochures and high expected IRR (2X, 2.2X, returns etc.). Of course there is small print. An audit would show how they have paid themselves high salaries and extended the period to 9 years. The actual IRR is about 2.5%

India REIT is extended again to Oct 2018. Screwing up of the investors continues. Extensions -noPayment. I invested in this fund and has lost 30,000 $ so far after 10 plus years .Is there any forum to take action against these High Way Robers /.

Though I am not an investor in this fund but seeing your pain and sufferings I want to know why don’t you file case against these cheaters which will cost you fraction of what you have lost. For any guidance, you may contact me.

I am also a fooled investor. Forget return, did not even get the capital back. Resutt of poor decision making by the fund managers caused this. Agree that ICICI wealth fund managers coerced me in investing into this though now they can easily say it was investors decision. On top of that Withholding tax. How we have been robbed while Piranal guys made their loot. How do we get togther to take acation?

Poor management , lack of proper due diligence and exorbitant management fees are the only characters tics of such PONZI Schemes. As a good luck of these ‘chor’ the victims have failed to organise any class action.